From the above analysis, the author is of the view that arbitrage of CryptoCurrencies or Virtual Currencies between a foreign country and India, is not permitted under the India laws despite the fact that there is no law, rule or regulation specifically prohibiting the same. Provided that the Reserve Bank may, on an application made to it and on being satisfied that it is necessary so to do, allow a person resident in India to accept or make a deposit from or with a person resident outside India. CryptoCurrencies or Virtual Currencies do not fall into the category of an actionable claim and money, as there is no claim, an action for the recovery of which can be made, and there is no promise to pay. It is an instrument which is not binding on any party and does not have any underlying capital asset or value. Accordingly, no payment out of India or to India can be made directly, except through an authorized person, who are bound to follow the rules and regulations including directions of RBI for the control of inbound and outbound currency.

India has two major exchanges – NSE and BSE and a majority of listed companies are traded on these two stock exchanges. This creates chances of arbitrage for traders interested in Indian stock exchanges. Joshi, who has access to both markets, can buy the stock on BSE at Rs. 346 and sell the same stock on NYSE at Rs. 350, thereby making a profit of Rs. 4 on every share transacted. The foreign exchange rate and underlying demand and supply conditions prevailing in both markets create favourable opportunities to carry out arbitrage trading.

Is currency arbitrage legal in India?

From the above analysis, the author is of the view that arbitrage of CryptoCurrencies or Virtual Currencies between a foreign country and India, is not permitted under the India laws despite the fact that there is no law, rule or regulation specifically prohibiting the same.

There are also fewer traders and less competition compared to many popular investment markets, all of which can lead to potential arbitrage opportunities. However, arbitrage opportunities also exist in the opposite direction, where you would buy on a smaller exchange and sell on a larger exchange. The recent surge in the popularity of cryptocurrency has led to a dramatic increase in trading volumes on many exchanges around the world. Those exchanges are not linked, and a low trading volume on some exchanges can mean that the price listed doesn’t adjust to the exchange average immediately. As a result, this has seen the creation of price differences arbitragers could potentially exploit.

Are Arbitrage Funds Better Than Liquid Funds?

For instance, if an investor has made a capital gain of Rs 100,000 on investment in an arbitrage fund and decides to withdraw the amount within 1 year, a short-term capital gain of 15 percent would be levied on that investor. Say, an equity share is priced at Rs 61.50 on the NSE whereas the same share is selling for Rs 61.55 on the BSE. Assuming intraday exchange trading is allowed, If one buys the stock on NSE and sells it on BSE, there is an arbitrage of Rs 0.05 to be earned on each share.

Stocks to futures arbitrage is not arbitrage and is hedging where you buy a stock as well as sell it in futures the same amount and so up or down movement in stock makes you profit in one and sell in other but then depending on what how your square off gives you profit. The thingy that caught my eye was the penalty you said about, that we have to pay it to the Stock exchange where we do the sell transaction. Now, having said that, could you give me a fair idea on how that penalty is computed.

Hence, it is always recommended to research before investing in the crypto market. However, the crypto market can give you more frequent arbitrage opportunities as compared to traditional intraday trading. Another example of arbitrage leading to price convergence can be observed within the futures markets. Futures arbitrageurs seek to exploit the value distinction between a futures contract and the underlying asset and require a simultaneous place in each asset courses. Arbitrage is the purchase and sale of an asset in order to profit from a difference in the asset’s price between markets.

Interestingly, there were some other ZebPay users who had executed the triangular arbitrage trade, whose profits were in the lower thousands. They also received an email regarding the level 2 KYC, which was approved within a few days and they were then able to access their funds. Speed is of the essence when doing this type of trading, so BTC’s slow transaction time could hurt your chances of making a profitable trade. You may want to consider transferring funds between exchanges using ETH, which offers faster transactions, instead. Another risk with arbitrage is if the market moves against you or a trade is already taken before you can execute your sell trade.

In such a scenario, a trader can arbitrage by selling shares of stock already present in his Demat account on one exchange. The trader can then buy the same amount from a different exchange. The most basic approach to cryptocurrency arbitrage is to do everything manually – monitor the markets for price differences and then place your trades and transfer funds accordingly. However, there are several cryptocurrency arbitrage bots available online, designed to make it as easy as possible to track price movements and differences. Online or mobile trading apps, such as Blockfolio, can also simplify the market monitoring process.

It is a trade that profits by exploiting the price differences of identical or similar financial instruments on different markets or in different forms. We can higher understand how this technique works through the following instance. The stock of Company X is buying and selling at $20 on the New York Stock Exchange whereas, on the identical second, it’s buying and selling for $20.05 on the London Stock Exchange . A trader can buy the stock on the NYSE and immediately is arbitrage legal in india promote the same shares on the LSE, earning a revenue of 5 cents per share. If the price difference between the two bullion markets reduces to Rs 200 per 10gm of gold, then the arbitrage opportunity between the two markets shall cease to exist, as the transaction costs shall be equal to, or more than, the price difference between the two markets. Irrespective of subsequent price movements, the difference in the prices between the two markets is the fund’s return.

What is Arbitrage Trading and How Does it Work

The basic concept of arbitrage is to buy an asset whereas concurrently promoting it at a better value, cashing in on the distinction. In astock-for-stock merger, risk arbitrage involves buying the shares of the target and promoting short the shares of the acquirer. When an organization announces its intent to accumulate one other company, the acquirer’s inventory value typically declines, whereas the goal firm’s stock price usually rises. However, the goal firm’s stock worth often remains beneath the introduced acquisition valuation. In an all-stock offer, a “risk arb” buys shares of the goal company and concurrently brief sellsshares of the acquirer. Insurance, Mutual Funds, IPO, NBFC, and Merchant Banking etc. being offered by us through this website are not Exchange traded product//services.

Is trading arbitrage illegal?

Arbitrage trading is not only legal in the United States, but is encouraged, as it contributes to market efficiency. Furthermore, arbitrageurs also serve a useful purpose by acting as intermediaries, providing liquidity in different markets.

As a retail investor, we may be able to spot some arbitrage opportunities. We see the price in BSE as 69.90 and in NSE as 74.90, which one can conclude as an arbitrage opportunity, but there is no arbitrage opportunity. In 2018, SEBI proposed the idea of Interoperability of exchanges. Interoperability now ensures that one can settle trades made on both NSE and BSE through a single clearing corporation.

How does cryptocurrency arbitrage work?

Tether tokens, the native tokens of the Tether network, trade under the USDT symbol. The US Justice Department issued subpoenas to dozens of firms as part of the sweeping probe focused on potentially manipulative trading around negative reports on listed companies published by some of their investors, media reports said. The issue of short selling has come to the fore following the market meltdown and the crash in Adani group stocks. They offer you copy trading facility across different segments like futures, options, cash, commodity etc.

Is retail arbitrage legal in India?

Some sellers also buy products they find online, which is known as online arbitrage, and the process is the same: buy low, sell high (on Amazon). You may be asking yourself, “is retail arbitrage legal?” Fortunately, it is.

Most arbitrage funds follow the Crisil BSE 0.23% liquid fund index as their benchmark index. On the contrary, if the fund manager has a reason to believe the company’s share prices are likely to fall in the future, he/she will sort a long contract in the futures market. The fund manager will short-sell the shares in the cash market at Rs. 1,235, and on the expiry date, the fund manager will buy the shares in the futures market at Rs. 1,200 and thereby earn a profit of Rs. 15 per share. But arbitrage is not the straightforward act of shopping for one asset at one market after which promoting it to another market at a later time when the worth is larger. Rather to avoid market dangers of value change you have to ensure that each the transactions at each the market are done simultaneously.

D-Street Recap: STT Hike for F&O, Banking Crisis, Fed Policy, Benchmarks

Hence moving money across the exchanges can be inefficient, making it hard for traders to arbitrage differences. Therefore, these price differences may persist for longer than they would in a more efficient market. For occasion, the options trader who writes call choices when she feels that they are overpriced could hedge her place by going lengthy inventory. In doing so, she is appearing as an intermediary between the options and the stock market. That is, she is shopping for stock from a inventory seller while concurrently selling an option to an option purchaser and contributing to the general liquidity of the 2 markets.

Day trading in cryptocurrency is similar to traditional intraday trading. The liquid and volatile nature of the cryptocurrency can easily enable day trading of crypto assets. However, it is essential to ensure that you invest in a trusted cryptocurrency trading platform. It should offer a safe and transparent trading environment along with heaps of crypto markets, including selecting crypto-cross and crypto-to-fiat pairs and low commissions. The arbitrageur would borrow the funds to purchase the underlying on the spot price and sell brief the futures contract. After storing the underlying, the arbitrageur can ship the asset at the future value, repay the borrowed funds, and revenue from the online difference.

You can review the most current version of the Terms of Use at any time, by clicking the Terms & Conditions link on the Website. No fee of whatsoever nature is to be charged for the use of this Website. So, if you fall under the high tax bracket and are looking for a low-risk investment opportunity, instead of parking your funds in pure debt funds, you can invest in arbitrage funds to get better tax-efficient returns. So, the Arbitrage funds are an ideal investment for investors looking to get exposure to the equities but have a low-risk appetite.

Features of Combiz Services Pvt Ltd Copy Trading

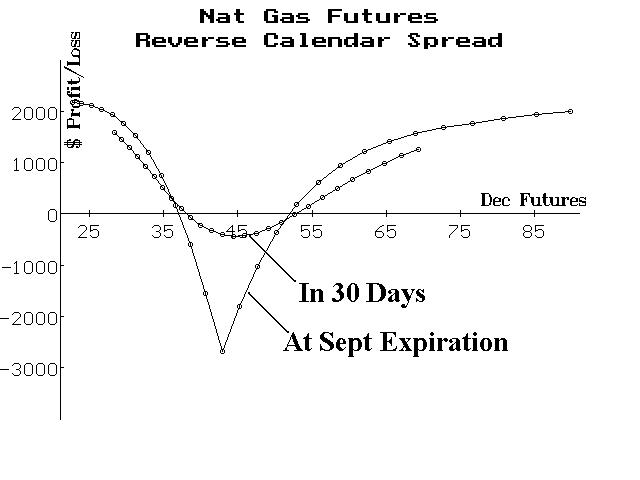

Let us first understand what is arbitrage and the actual arbitrage definition. Arbitrage trading is about taking advantage of such anomalies in pricing which can be capitalized for riskless profits. Whenever futures are trading at a substantial discount to spot, a reverse cash and carry arbitrage opportunity arises.

- Nothing here is to be construed as an investment or financial or taxation advice nor to be considered as an invitation or solicitation or advertisement for any financial product.

- So, if you sell at a higher price and buy identical shares at a lower price, you stand to make gains.

- The arbitrageur would borrow the funds to purchase the underlying on the spot price and sell brief the futures contract.

- To avoid complicating things, let us understand merger arbitrage with the help of an example.

- While we receive compensation when you click links to partners, they do not influence our content.

- Spatial arbitrage is the type of arbitrage where the arbitrageur buys stock in one market and sells it in another market where the price is higher.

• Account Manager- We offer you to manage MT4/5, No specialized software, complex setups or VPS servers are necessary. Income from transfer of virtual digital assets such as crypto, NFTs will be taxed at 30%. Just follow one simple rule Choose couple of best fund in each category through ValueResearchOnline and select the one that you think would perform better in upcoming time based on their stock portfolio.

How does arbitrage work in India?

How Does Arbitrage Work in India? A trader can sell shares on one stock exchange and then purchase identical shares on another exchange if one already has shares in a free demat account. Therefore, a trader can earn a profit if he sells at a higher price and purchases identical shares at a lower price.